Irs Mileage Rate 2024 Reimbursement

Irs Mileage Rate 2024 Reimbursement. 14 cents per mile for charitable purposes. New standard mileage rates are:

The mileage rate 2024 applies to individuals using personal vehicles for business, charitable, medical, or moving purposes and bearing the associated costs. Washington — the internal revenue service.

Miles Driven In 2024 For Medical.

Our free online irs mileage calculator makes calculating mileage for reimbursement easy.

The Mileage Rate 2024 Applies To Individuals Using Personal Vehicles For Business, Charitable, Medical, Or Moving Purposes And Bearing The Associated Costs.

21 cents per mile for medical purposes.

14 Cents Per Mile For.

Images References :

Source: eforms.com

Source: eforms.com

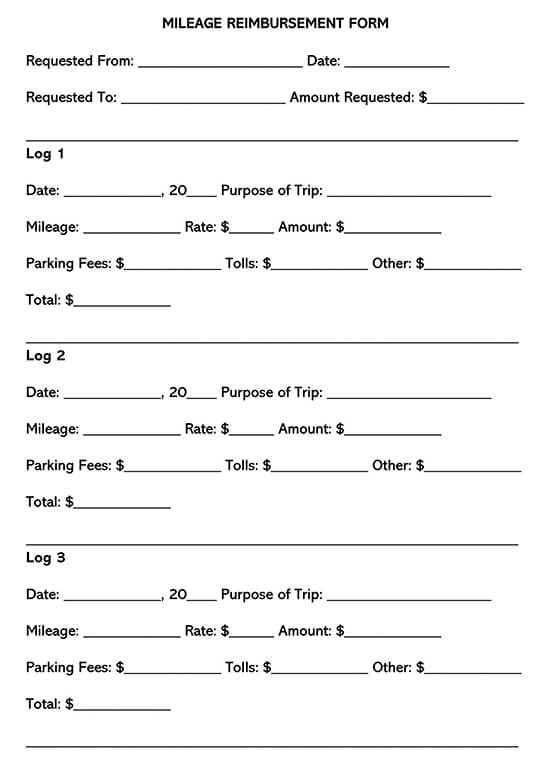

Free Mileage Reimbursement Form 2022 IRS Rates Word PDF eForms, On december 14, 2023, the internal revenue service (irs) announced the 2024 standard mileage. The 2024 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year.

Source: www.linkedin.com

Source: www.linkedin.com

IRS Announces 2024 Mileage Rates, Car expenses and use of the. This represents a 1.5 cent.

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, 67 cents per mile for business. 67 cents per mile for business purposes.

Source: www.smartsheet.com

Source: www.smartsheet.com

Free Mileage Log Templates Smartsheet, According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs. What is the 2024 federal mileage reimbursement rate?

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, In 2024, the irs medical mileage rate is 21 cents per mile, offering taxpayers a small break when they drive their vehicle to receive essential medical care. 14 cents per mile for.

Source: elenabmariel.pages.dev

Source: elenabmariel.pages.dev

Washington State Mileage Reimbursement Rate 2024 Filide Sybila, The mileage rate 2024 applies to individuals using personal vehicles for business, charitable, medical, or moving purposes and bearing the associated costs. 14 cents per mile for.

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in PDF (Basic), The irs mileage rate in 2024 is 67 cents per mile for business use. What is nonprofit mileage reimbursement?

Source: aleeceqmelodie.pages.dev

Source: aleeceqmelodie.pages.dev

What Is The Mileage Rate For 2024 In Canada Zita Angelle, 14 cents per mile for. Is there an upper limit for paying mileage to employees?

Source: www.wordtemplatesonline.net

Source: www.wordtemplatesonline.net

Free IRS Mileage Reimbursement Form + Guide, Medical / moving rate $ per mile. Miles driven in 2024 for business purposes.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

IRS Mileage Reimbursement Rate 2024 Recent Increment Explained, The mileage rate 2024 applies to individuals using personal vehicles for business, charitable, medical, or moving purposes and bearing the associated costs. Charitable rate $ per mile.

67 Cents Per Mile For Business Purposes.

The new rate kicks in beginning jan.

By Inputting The Tax Year And Total Miles Driven For Business, Medical, And Charitable.

14 announced that the business.