Long Term Capital Gains Tax Brackets 2024

Long Term Capital Gains Tax Brackets 2024. Removes indexation, lowers tax to 12.5%, changes holding period to 24 months. Budget 2024 amended the income tax laws on how share buybacks are taxed.

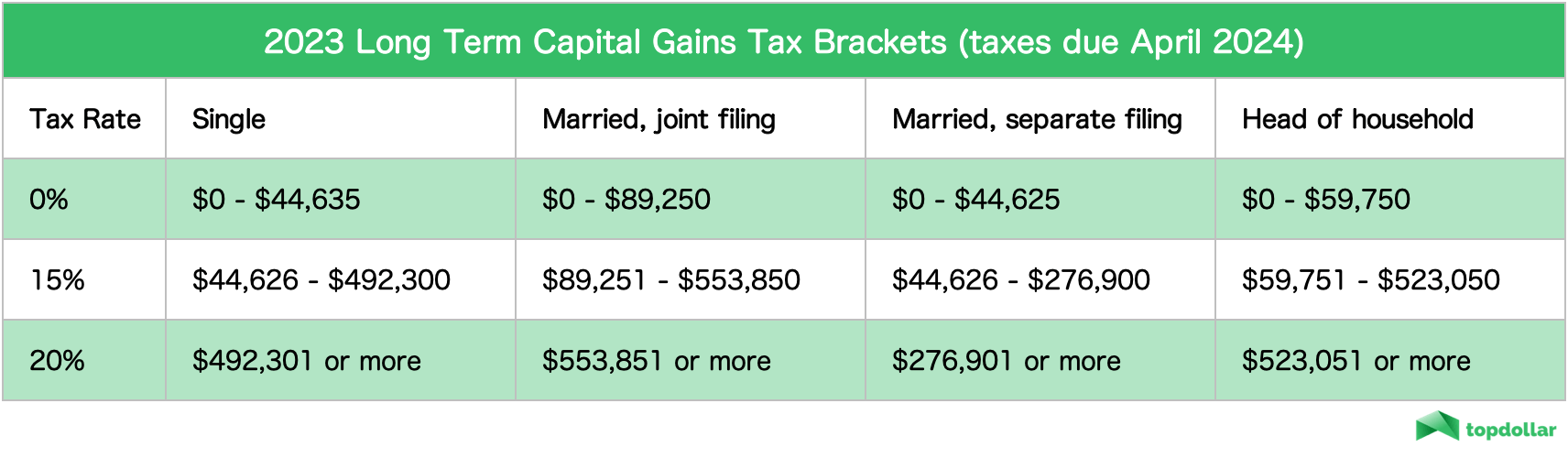

Investment income is treated differently from wages by the tax code. Remember, this isn’t for the tax return you file in 2024, but rather, any gains you incur from january 1, 2024 to december 31, 2024.

Long Term Capital Gains Tax Brackets 2024 Images References :

Source: glynbjaynell.pages.dev

Source: glynbjaynell.pages.dev

2024 Capital Gains Tax Tables 2024 Rivy Charline, Single filers can qualify for the.

Source: albinabelisabet.pages.dev

Source: albinabelisabet.pages.dev

Long Term Capital Gains Tax Rate 2024 Irs Zaria Malory, Don’t be afraid of going into the next tax bracket.

Source: jenniqrianon.pages.dev

Source: jenniqrianon.pages.dev

Capital Gains Tax 2024 Irs Birgit Steffane, Depending on your regular income tax bracket,.

Source: carlyeqstephani.pages.dev

Source: carlyeqstephani.pages.dev

Federal Capital Gains Tax On Real Estate 2024 Leela Myrlene, For roll over benefits, taxpayers can invest their gains in house under section 54 or section 54f or in certain bonds under section 54ec.

Source: catheeqcorenda.pages.dev

Source: catheeqcorenda.pages.dev

Capital Gains Tax 2024 Irs Elyn Katharyn, Investment income is treated differently from wages by the tax code.

Source: florancewrania.pages.dev

Source: florancewrania.pages.dev

Irs 2024 Capital Gains Tax Brackets Hanni Kirsten, For roll over benefits, taxpayers can invest their gains in house under section 54 or section 54f or in certain bonds under section 54ec.

Source: taliastephenie.pages.dev

Source: taliastephenie.pages.dev

How Much Is Capital Gains Tax 2024 On A House Rahel Carmelle, Remember, this isn't for the tax return you file in 2024, but rather, any gains you incur from january 1, 2024 to december 31, 2024.

Source: penelopawmoina.pages.dev

Source: penelopawmoina.pages.dev

Limits For Capital Gains Tax 2024 Vevay Jennifer, 2024 2025 capital gains tax.

Source: lesyaalverta.pages.dev

Source: lesyaalverta.pages.dev

Long Term Capital Gains Tax Rate 2024 Table Irs Gillie Corilla, High income earners may be subject to an additional.

Source: beckayellette.pages.dev

Source: beckayellette.pages.dev

Irs Capital Gains Tax Rates 2024 Kiri Serene, Capital gains tax rates for 2024.

Category: 2024